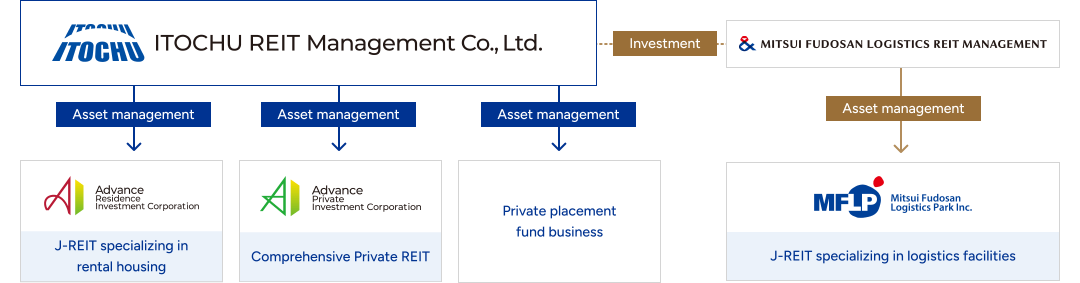

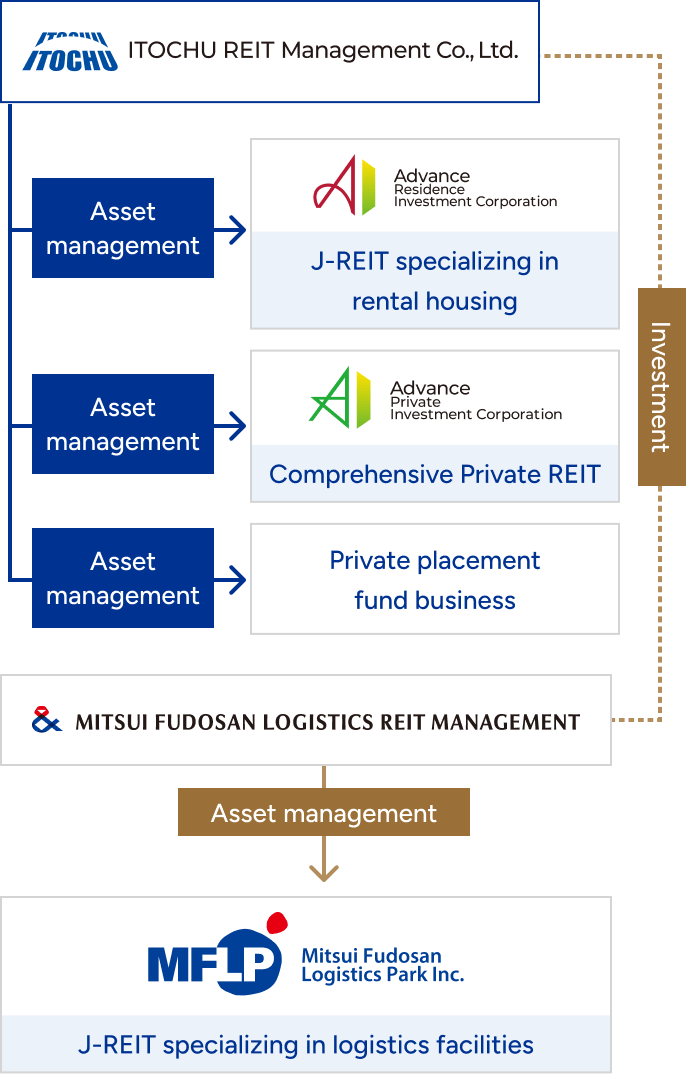

As a comprehensive asset management company, ITOCHU REIT Management (IRM) manages a diverse portfolio of real estate assets that are closely connected to both people’s lives and corporate activities. These assets include “Advance” branded J-REITs, which specialize in rental housing, comprehensive private REITs, and assets held by private funds.

IRM also holds a stake in Mitsui Fudosan Logistics REIT Management Co., Ltd. and collaborates with the company in the area of human resources. This enabled IRM to participate in the management of Mitsui Fudosan Logistics Park Inc., a J-REIT specializing in logistics facilities, co-sponsored by Mitsui Fudosan and the ITOCHU Group.

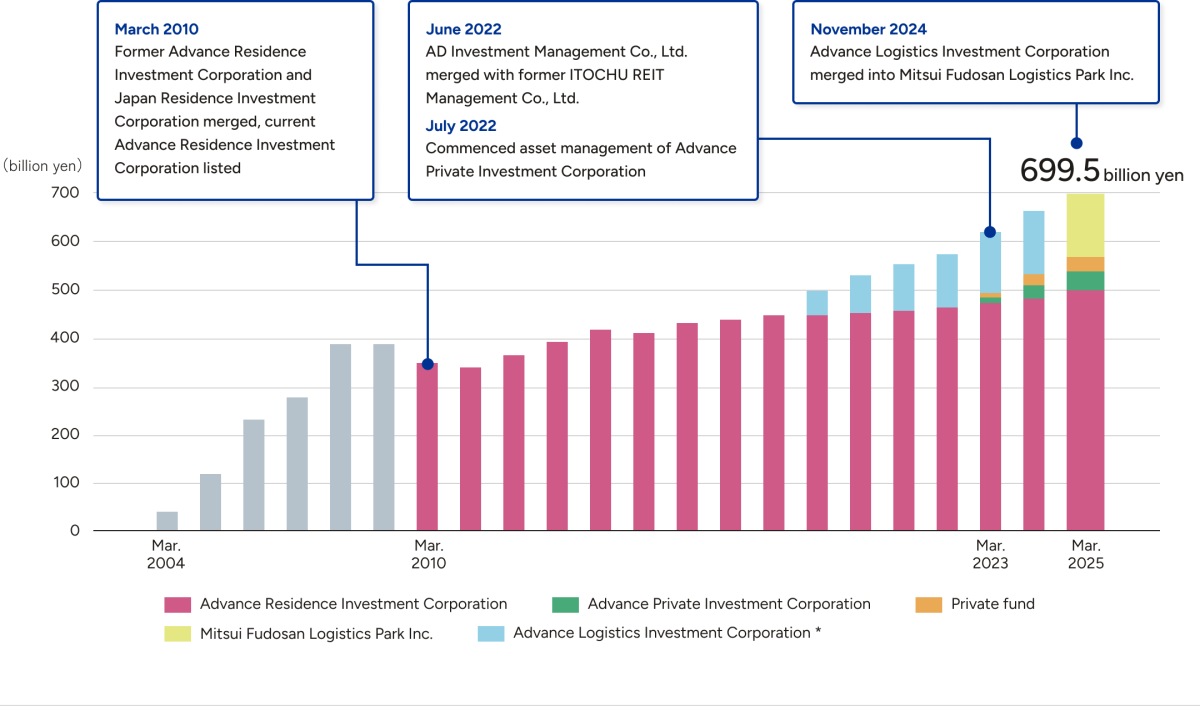

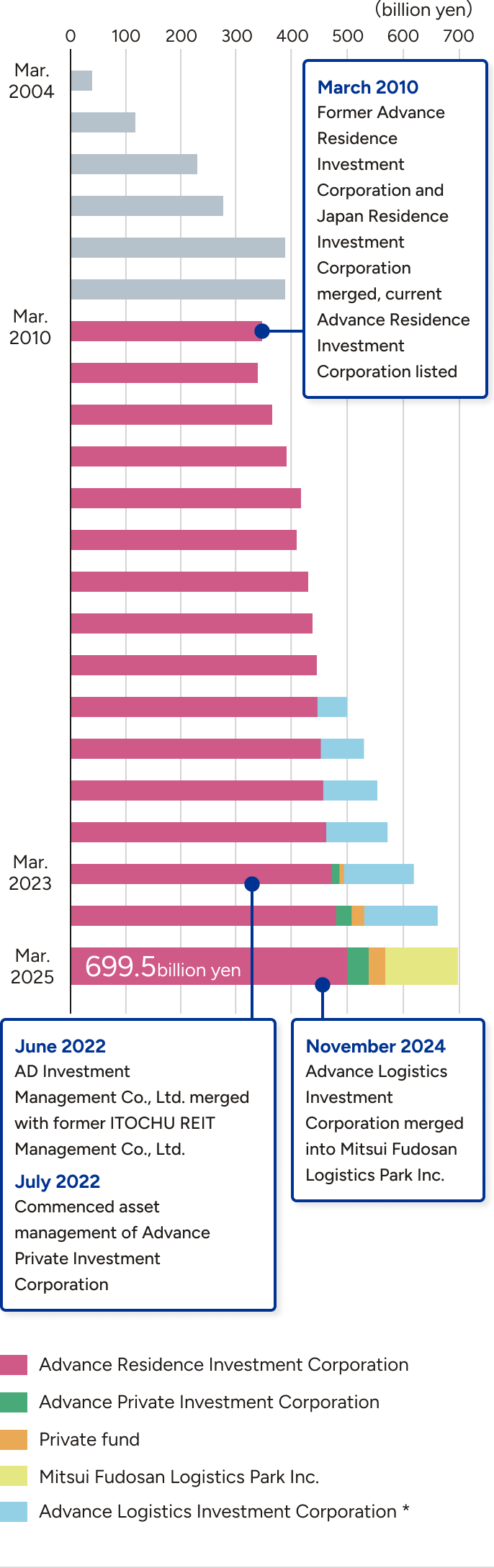

Changes in assets under management

Total Assets under management

about699.5billion yen

※The balance of assets under management is as of March 31,2025.

※Rounded to the nearest 1 hundred million yen.

As of November 1, 2024, Advance Logistics Investment Corporation (ADL) merged into Mitsui Fudosan Logistics Park Inc. (MFLP), with ADL being the dissolving company.

- Respective REITs’ data are based on the acquisition price as of the latest settlement date, factoring in the prices of property acquisitions and sales that occurred from the day following the settlement date up to each point in time.

- For certain private funds, the amount invested by equity investors is regarded as the value of their assets under management.

- IRM owns 23% of the shares in Mitsui Fudosan Logistics REIT Management Co., Ltd. (MFLM), the asset management company for MFLP. The graphs for the period after March 2025 show the amount of MFLP’s assets under management (AUM) after applying a 23% factor, which represents IRM’s ownership percentage in MFLM.

The Investment Corporations and Their Businesses

Listed REITs

J-REIT specializing in rental housing

One of the largest residential J-REITs in terms of assets. Based on the basic policy of 'realizing long-term, stable distributions of profits', it has built a well-balanced portfolio with diversified investments in investment areas and types of residential units. Advance Residence Investment Corporation has developed the rental residential brand RESIDIA. It responds to various lifestyles and offers the value of comfortable living.

Private REIT

Comprehensive Private REIT

An unlisted, open-ended REIT for institutional investors. They undergo operations aiming for both stability and expansion of profitability by building a comprehensive portfolio that includes assets with stable cash flow such as rental housing, logistics facilities, and commercial facilities (land), as well as assets with growth potential such as offices and accommodation facilities.

Private placement fund business

The private placement fund business engages in asset management of real estate private funds, and aim to maximize investor profits by formulating and executing investment strategies that meet the needs of investors.

They also handle private placements for overseas real estate funds and strive to offer new investment opportunities for domestic institutional investors.